Risk-based Portfolio Allocation Strategies

ctrucios@unicamp.br

Instituto de Matemática, Estatística e Computação Científica (IMECC),

Universidade Estadual de Campinas (UNICAMP).

A statistician working on portfolio allocation?

A statistician working on portfolio allocation?

A statistician working on portfolio allocation?

A statistician working on portfolio allocation?

Introduction

Introdução

Introdução

- Suponha que temos 2 ativos, \(A\) e \(B\), nos quais estamos interessados em investir. Como alocaria seus recursos neste investimento?

- Suponha que temos 2 ativos, \(A\) e \(B\), com retornos esperados de \(3\) e \(5\) e variâncias iguais \(2\) e \(4\), respectivamente. Como alocaria seus recursos de forma a maximizar seu retorno esperado e minimizar seu risco?

- Suponha que temos 2 ativos, \(A\) e \(B\), com retornos esperados de \(3\) e \(5\) e variâncias iguais \(2\) e \(4\), respectivamente e correlação igual a 0.5. Como alocaria seus recursos de forma a maximizar seu retorno esperado e minimizar seu risco?

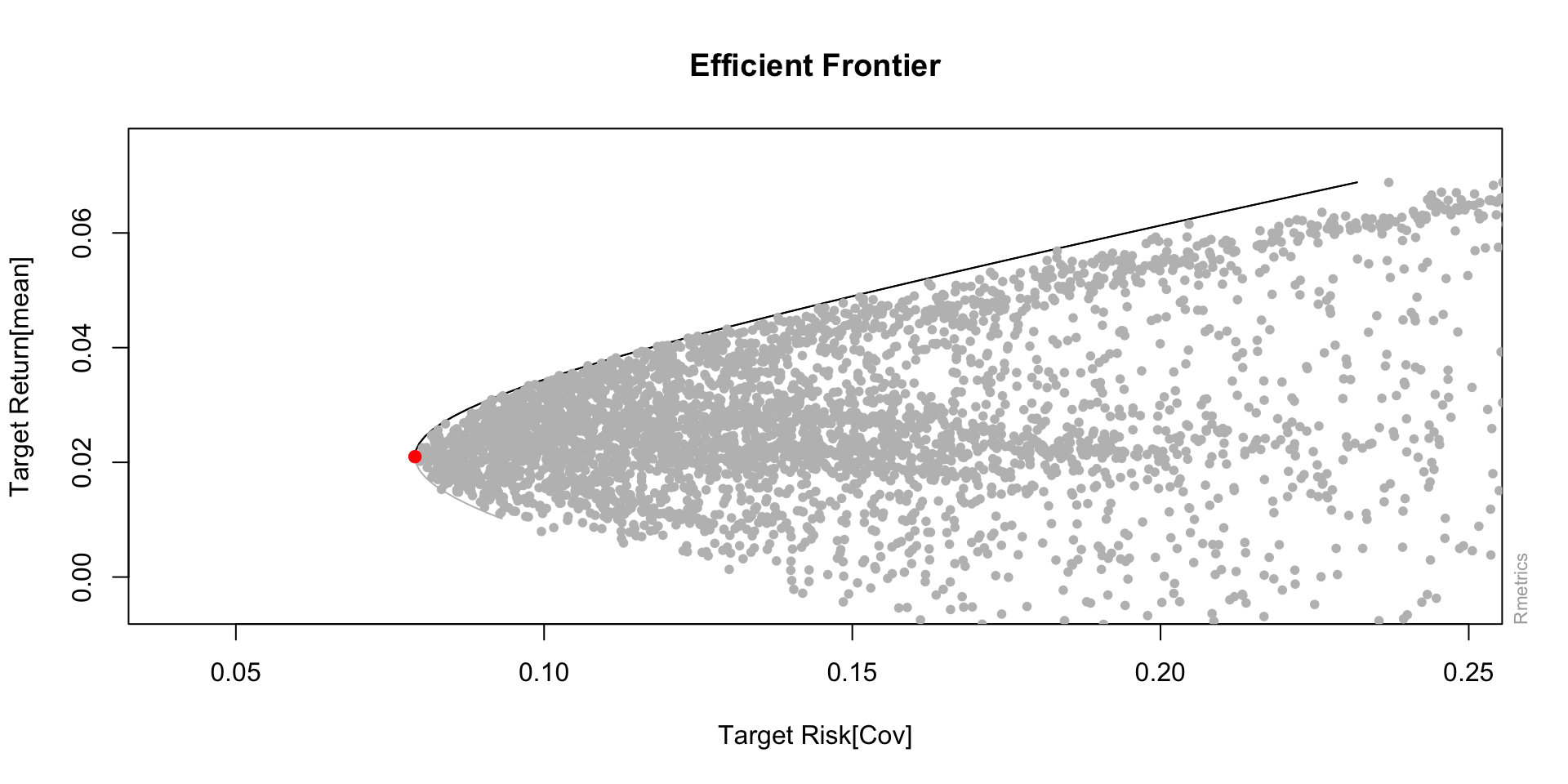

- Seja \(\omega\) e \(\mu\) os vetores (coluna) de pesos e retornos esperados, respectivamente e seja \(\Sigma\) a matriz de covariância associada (risco). Queremos maximizar \[\mu' \omega - \lambda \omega' \Sigma \omega,\] em que \(\lambda\) é o parâmetro de aversão ao risco (quanto maior, mais advessos ao risco somos)

Markowitz

Markowitz (1952)

Markowitz

Quando \(\lambda\) é grande, o problema a ser resolvido, torna-se, aproximadamente, minimizar \[\omega' \Sigma \omega,\]

- Vamos assumir que todo nosso capital será alocado, ou seja \(\displaystyle \sum_{i = 1}^N\omega_i = 1\)

- Então, queremos minimizar com restrição

Markowitz

Seja um portfolio com \(N\) ativos e matriz de covariância \(\Sigma\). Queremos minimizar \[L(\boldsymbol{\omega}, \lambda) = \boldsymbol{\omega}' \Sigma \boldsymbol{\omega} + \lambda (\boldsymbol{1}'\boldsymbol{\omega} - 1),\] em que \(\boldsymbol{1} = [1, 1, \cdots, 1]'.\)

Derivando w.r.t. \(\boldsymbol{\omega}\) e \(\lambda\)

- \(\dfrac{\partial L}{\partial \boldsymbol{\omega}} = 2 \Sigma \boldsymbol{\omega} + \lambda \boldsymbol{1}\)

- \(\dfrac{\partial L}{\partial \lambda} = \boldsymbol{1}' \boldsymbol{\omega} - 1\)

Igualando a zero, \[\Sigma \boldsymbol{\omega} = - \dfrac{\lambda \boldsymbol{1}}{2} \rightarrow \boldsymbol{\omega} = \dfrac{-\lambda}{2} \Sigma^{-1} \boldsymbol{1}\]

Markowitz

Igualando a zero \(\dfrac{\partial L}{\partial \lambda} = \boldsymbol{1}' \boldsymbol{\omega} - 1\), temos:

\[1 = \boldsymbol{1}' \boldsymbol{\omega} = \dfrac{-\lambda}{2} \boldsymbol{1}' \Sigma^{-1} \boldsymbol{1} \rightarrow \lambda = \dfrac{-2}{\boldsymbol{1}' \Sigma^{-1} \boldsymbol{1}}.\]

Assim,

\[\boldsymbol{\omega} = \dfrac{-\lambda}{2} \Sigma^{-1} \boldsymbol{1} = \dfrac{\Sigma^{-1} \boldsymbol{1}}{\boldsymbol{1}' \Sigma^{-1} \boldsymbol{1}},\] são os pesos ótimos da carteira de variância mínima.

Hands-On I

Hands-On I

Utilizando retornos mensais das ações na B3, calcularemos os pesos para a carteira de variância mínima. Utilizaremos os pacotes do R yfR, RiskPortfolios, tidyr e dplyr.

Hands-On I

Hands-On

Code

Hands-On

Code

[,1]

ASSET1 0.1450

ASSET2 0.2530

ASSET3 0.2270

ASSET4 0.1988

ASSET5 0.1868

ASSET6 -0.0297

ASSET7 0.0578

ASSET8 0.0150

ASSET9 -0.0505

ASSET10 -0.0033\[\boldsymbol{\omega} = \dfrac{\Sigma^{-1} \boldsymbol{1}}{\boldsymbol{1}' \Sigma^{-1} \boldsymbol{1}},\]

Hands-On

Code

omega

ASSET1 0.14497249 0.14497249

ASSET2 0.25304038 0.25304038

ASSET3 0.22699176 0.22699176

ASSET4 0.19881419 0.19881419

ASSET5 0.18675677 0.18675677

ASSET6 -0.02965077 -0.02965077

ASSET7 0.05782148 0.05782148

ASSET8 0.01501568 0.01501568

ASSET9 -0.05046142 -0.05046142

ASSET10 -0.00330055 -0.00330055Hands-On I

- Na prática, \(\Sigma\) não é conhecido, devendo ser estimado com os dados (\(\hat{\Sigma}\)).

- Utilizar \(\hat{\Sigma}\) em lugar de \(\Sigma\) implica em erro de estimação.

- Isto faz com que os pesos estejam alocados em poucos ativos, exista pouca diversificação e o desempenhho fora da amostra seja pobre 😢

- Para lidar com este problema, diversas abordagens tem sido propostas.

Observações:

- Na prática é muito dificil estimar \(\mu\). É por isso que carteiras baseadas em rico (\(\Sigma\)) são preferidas.

- É comúm impor a restrição de que \(\omega_i \geq 0\) (no-short-selling constraints ou restrição de não venda a descoberto).

Hands-On I

Outros portfolios

Outros portfolios

Pesos iguais

- Também chamada de estratégia ingênua ou \(1/N\).

- É a estratégia mais simples e não precisa cálculos difíceis nem resolver problemas de otimização.

- Para um conjunto de \(N\) ativos financeiros, os pesos são obtidos como \[\omega_i = 1/N, \quad \forall i= 1, \cdots, N.\]

- Apesar da sua simplicidade, diversos autores mencionam que o desempenho fora da amostra desta estratégia é dificilmente superado por métodos mais complexos (DeMiguel et al. 2009)

Outros portfolios

Volatilidade inversa

Proposto por Leote De Carvalho et al. (2012), esta estratégia não leva em consideração covariâncias, mas apenas variâncias. Os pesos são obtidos como:

\[\boldsymbol{\omega} = \Big( \dfrac{1/\sigma_1}{ \displaystyle \sum_{j = 1}^N 1/\sigma_j}, \cdots, \dfrac{1/\sigma_N}{ \displaystyle \sum_{j = 1}^N 1/\sigma_j} \Big)'\]

No R

optimalPortfolio(Sigma, control = list(type = 'invvol', constraint = 'lo'))

Outros portfolios

Diversificação máxima

Proposto por Choueifaty and Coignard (2008), o objetivo é maximizar a razão \[DR = \dfrac{\boldsymbol{\omega}'\boldsymbol{\sigma}}{\sqrt{\boldsymbol{\omega}' \Sigma \boldsymbol{\omega}}},\] sujeito á restrição de que \(\boldsymbol{1}' \boldsymbol{\omega} = 1\) e \(\omega_i \geq 0\) e em que \(\boldsymbol{\sigma} = \sqrt{diag(\Sigma)}\).

Note que no caso extremos de que a carteira esteja formada po apenas um ativo, \(DR = 1\), implicando uma carteira pobremente diversificada.

No R

optimalPortfolio(Sigma, control = list(type = 'maxdiv', constraint = 'lo'))

Outros portfolios

Igual contribuição ao risco

Popularizada por Qian (2005), a ideia desta estratégia é que cada um dos ativos tenha a mesma contribuição marginal ao risco (volatilidade) da carteira, ou seja, que a proporção da contribuição ao risco de cada ativo deve ser \(1/N\). Ativos com pouco risco receberão pessos maiores e ativos com muito risco receberão pesos menores.

Os pesos são obtidos minimizando \[\displaystyle \sum_{i = 1}^N (\%RC_i - 1/N)^2,\] sujeito á restrição de que \(\boldsymbol{1}' \boldsymbol{\omega} = 1\), em que \(\%RC_i = \omega_i [\Sigma \boldsymbol{\omega}]_i / \boldsymbol{\omega}' \Sigma \boldsymbol{\omega}\) é a porcentagem de risco com que o ativo \(i\) contribui para o risco total.

No R

optimalPortfolio(Sigma, control = list(type = 'erc', constraint = 'lo'))

Outros portfolios

Máxima decorrelation

Proposto por Christoffersen et al. (2012), esta estratégia pode ser vista como um caso particular do portfolio de variância mínima mas com \(\rho\) (matriz de correlação) em lugar de \(\Sigma\) (matriz de covariância). Assim, queremos minimizar \[\boldsymbol{\omega} \rho \boldsymbol{\omega},\] sujeito á restrição de que \(\boldsymbol{1}' \boldsymbol{\omega} = 1\)

No R

optimalPortfolio(Sigma, control = list(type = 'maxdec', constraint = 'lo'))

Hands-On II

Hands-On II

Utilizando os dados anteriores, calcularemos os pesos ótimos utiliando as estratégias vistas anteriormente.

Code

omega_invol <- optimalPortfolio(Sigma, control = list(type = 'invvol', constraint = 'lo'))

omega_erc <- optimalPortfolio(Sigma, control = list(type = 'erc', constraint = 'lo'))

omega_maxdiv <- optimalPortfolio(Sigma, control = list(type = 'maxdiv', constraint = 'lo'))

omega_maxdec <- optimalPortfolio(Sigma, control = list(type = 'maxdec', constraint = 'lo'))Hands-On II

Code

MV IV ERC MaxDiv MaxDec

ASSET1 0.14441636 0.10180771 0.10302562 0.04982798 0.04891108

ASSET2 0.19927819 0.10138439 0.08394694 0.03722635 0.03669391

ASSET3 0.19731862 0.10180305 0.10214902 0.12238143 0.12013496

ASSET4 0.19871602 0.10124235 0.14352016 0.19926099 0.19668659

ASSET5 0.18682494 0.10154481 0.10313840 0.07846716 0.07722268

ASSET6 0.00000000 0.09871593 0.09834150 0.07444889 0.07536776

ASSET7 0.05856234 0.09900181 0.10191129 0.15308962 0.15453158

ASSET8 0.01488354 0.09823150 0.10044598 0.12267356 0.12480008

ASSET9 0.00000000 0.09820804 0.08129069 0.05246468 0.05338689

ASSET10 0.00000000 0.09806042 0.08223041 0.11015936 0.11226446ML Risk-Based Portfolios

ML Risk-Based Portfolios

- Recentemente, novas estratégias de alocação de carteiras baseadas em machine learning tem surgido na literatura.

- Algumas destas estratégias utilizam algoritmos de clusterização hierárquica (HRP, HCAA, HERC, DHRP).

- Estas estratégias surgem para superar algumas das limitações da estratégia de Markowitz, bem como incluir a ideia de que “sistemas complexos, como o mercado financeiro, estão organizados de forma hierárquica”

ML Risk-Based Portfolios

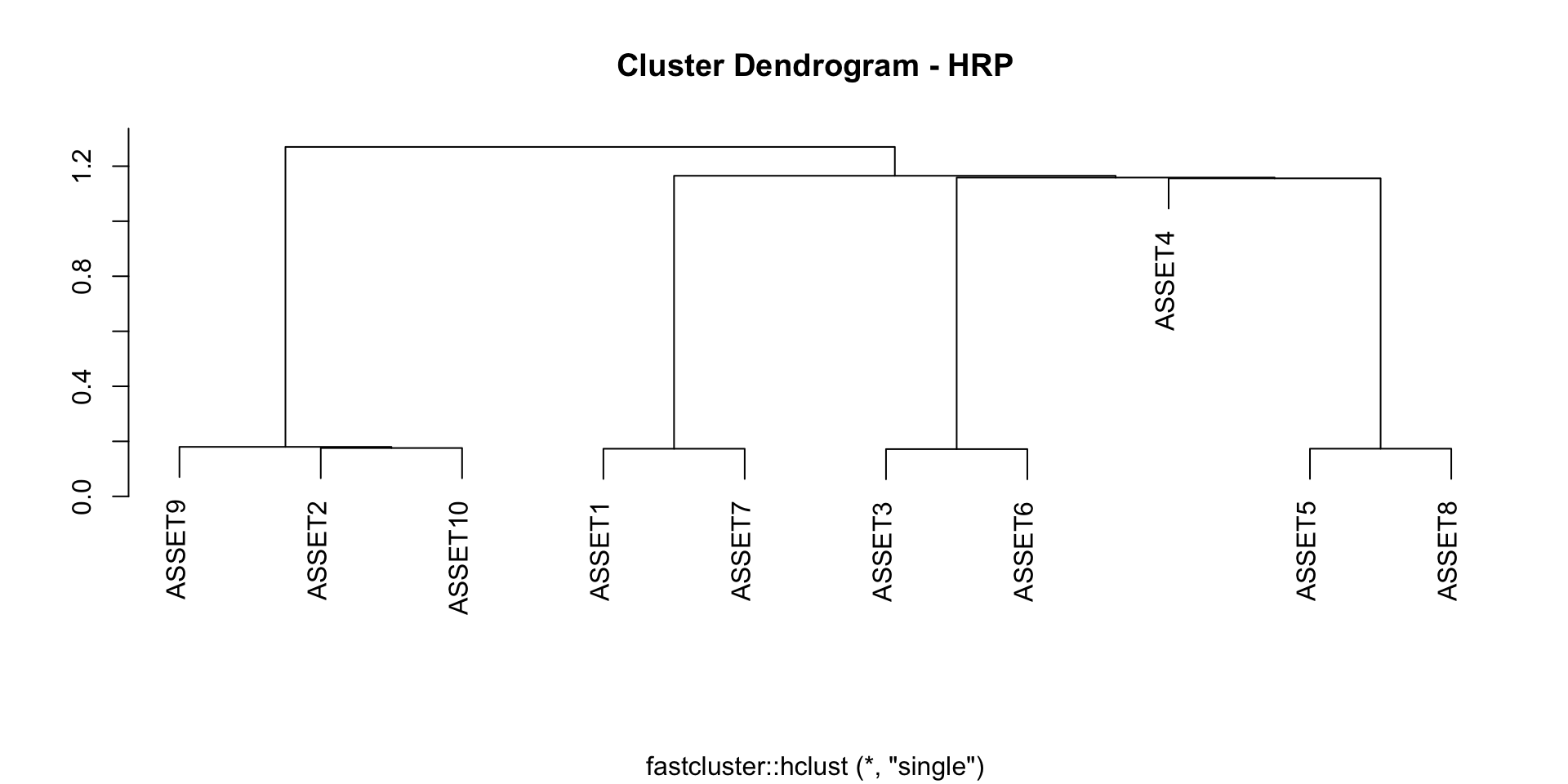

Hierarchical Risk Parity (HRP)

- Proposta por Lopez de Prado (2016)

- Surge como uma alternativa para evitar os problemas observados da optimização de Markowitz.

- A ideia básica do algoritmo é transformar a matriz de covariância em matriz de distâncias, aplicar um método de agrupamento hierárquico, fazer bissecções e calcular os pesos através da estratégia de volatilidade inversa.

ML Risk-Based Portfolios

Hierarchical Risk Parity (HRP)

- A matriz de distância utilizada no método de agrupamento hierárquico é denotada por \(\tilde{D}\) cujos elementos \({\tilde{d}_{ij}}\) são obtidos como \[\tilde{d}_{ij} = \sqrt{\displaystyle \sum_{k = 1}^N (d_{ki} - d_{kj})^2},\] em que \(N\) é o número de ativos e \(d_{ij} = \sqrt{0.5 \times (1 - \rho_{ij})}\) com \(\rho_{ij}\) sendo a correlaçõ entre os ativos \(i\) e \(j\).

ML Risk-Based Portfolios

Hierarchical Risk Parity (HRP)

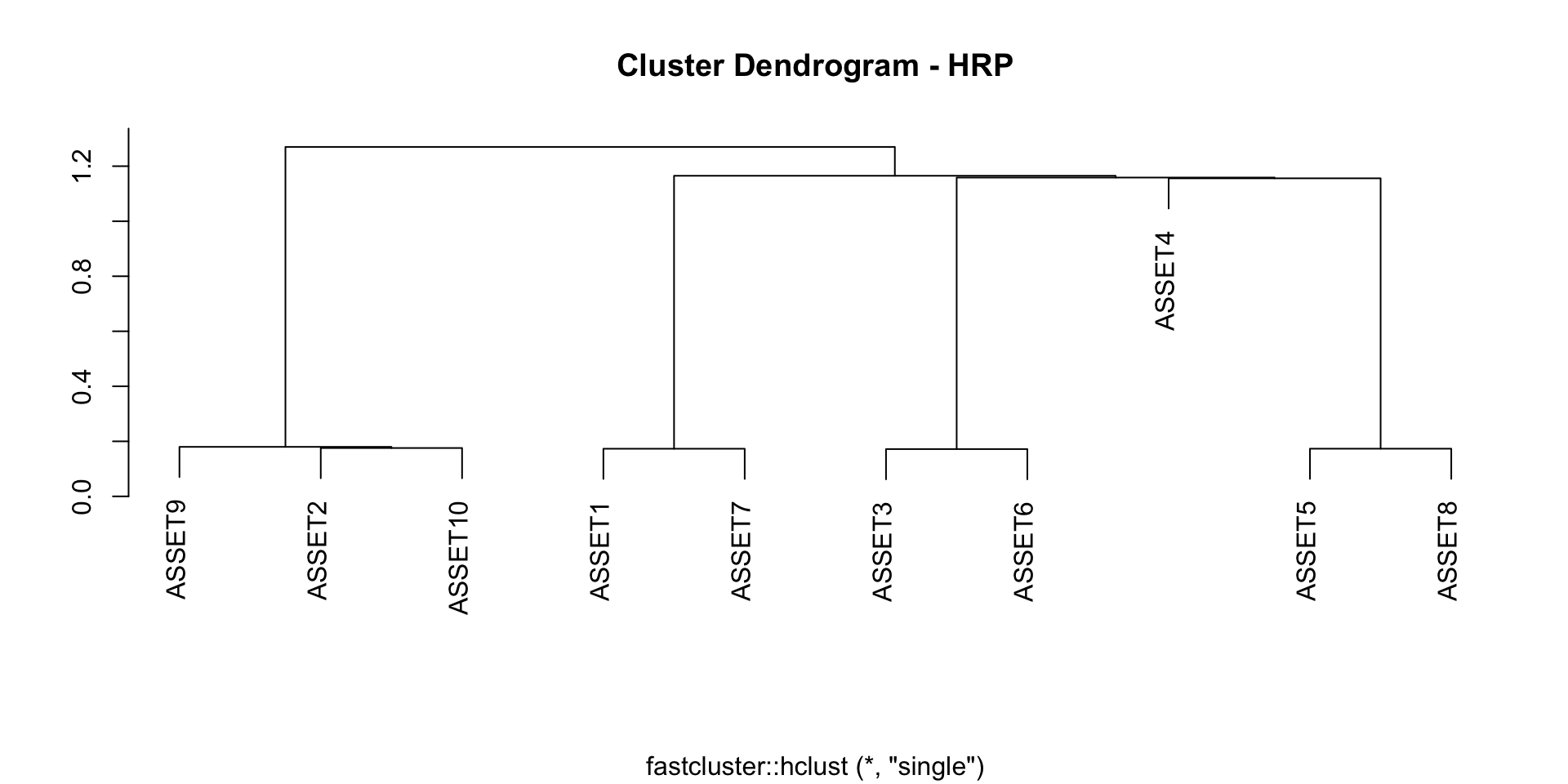

ML Risk-Based Portfolios

Hierarchical Risk Parity (HRP)

- Inicialize todos os pesos em \(\omega_i = 1\)

- Dentro de cada grupo, o vetor de pesos prévios do grupo \(k\) (\(k = 1, 2\)) é obtido através do método de volatilidade inversa, \[\boldsymbol{\omega}_{aux}^{(k)} = \dfrac{1}{Trace(Diag(\Sigma^{(k)})^{-1})} \times Diag(\Sigma^{(k)})^{-1},\] em que \(\Sigma^{(k)}\) é a matriz de covariância dos ativos no grupo \(k\).

- Com os pesos obtidos, calculamos a variância de cada grupo como \(V^{(k)} = \boldsymbol{\omega}_{aux}^{(k)} \Sigma^{(k)}\boldsymbol{\omega}_{aux}^{(k) \prime},\) e, finalmente \(\alpha = 1 - \frac{V^{(1)}}{V^{(1)} + V^{(2)}}\) que é um fator de ponderação que atualizará o peso de cada ativo.

- Os pesos finais são atualizados para \(\boldsymbol{\omega}^{(1)} = \alpha \boldsymbol{\omega}^{(1)}\) e \(\boldsymbol{\omega}^{(2)} = (1 - \alpha) \boldsymbol{\omega}^{(2)}\).

- O processo se repete até que cada grupo tenha apenas um ativo.

ML Risk-Based Portfolios

Hierarchical Risk Parity (HRP)

ML Risk-Based Portfolios

Hierarchical Risk Parity (HRP)

ML Risk-Based Portfolios

Hierarchical Risk Parity (HRP)

- Uma das críticas do HRP é que ele não utiliza a clusterização mas apenas a ordem.

- Algumas modificações do algoritmo surguiram na literatura:

- Hierarchical Clustering-Based Asset Allocation (HCAA) (Raffinot, 2017)

- Hierarchical Equal Risk Contribution (HERC) (Raffinot, 2018)

- A Constrained Hierarchical Risk Parity Algorithm with Cluster-based Capital Allocation (DHRP) (Pfitzingera and Katzke, 2019)

ML Risk-Based Portfolios

A Constrained Hierarchical Risk Parity Algorithm with Cluster-based Capital Allocation (DHRP)

- Visando incorporar uma maior parte da informação extraida a partir da clusterização, bem como incluir algumas práticas usuais do mercado financeiro, Pfitzinger et al.(2019) propõe três modificações à proposta de Lopez de Prado (2016).

- A primeira modificação consiste em utilizar um algoritmo divisivo em vez de algoritmo aglomerativo como sugerido por Lopez de Prado (2016).

- Permite a inclusão de restrições nos pesos e,

- Através de um parâmetro \(\tau\), é possível aproveitar toda a estrutura hierarquica obtida na clusterização (\(\tau = 1\)), parte dela (\(\tau \in (0, 1)\)) ou apenas a ordenação (\(\tau = 0\)).

ML Risk-Based Portfolios

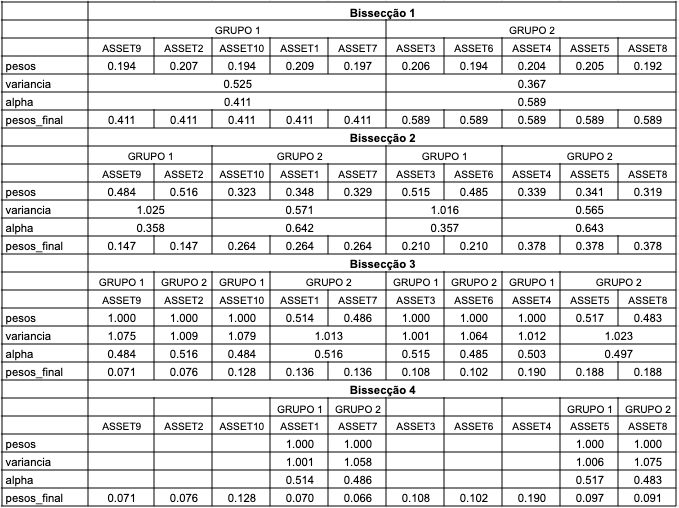

Hierarchical Clustering-Based Asset Allocation (HCAA)

- HRP e DHRP não levam em consideração o número de clusters a serem formados.

- HCAA leva isto em consideração e, após selecionar o número de grupos a serem formados, os pesos são calculados entre os grupos e dentro dos grupos.

- A ideia é distribuir o capital total a ser investido de forma igual entre os clusters hierarquicamente (assim ativos correlacionados que formarão um cluster recebem o mesmo peso total do que um ativo não correlacionado, obtendo diversificação).

- Dentro de cada cluster, os pesos são calculados através da estratégia de pesos iguais.

ML Risk-Based Portfolios

Hierarchical Clustering-Based Asset Allocation (HCAA)

ML Risk-Based Portfolios

Hierarchical Clustering-Based Asset Allocation (HCAA)

ML Risk-Based Portfolios

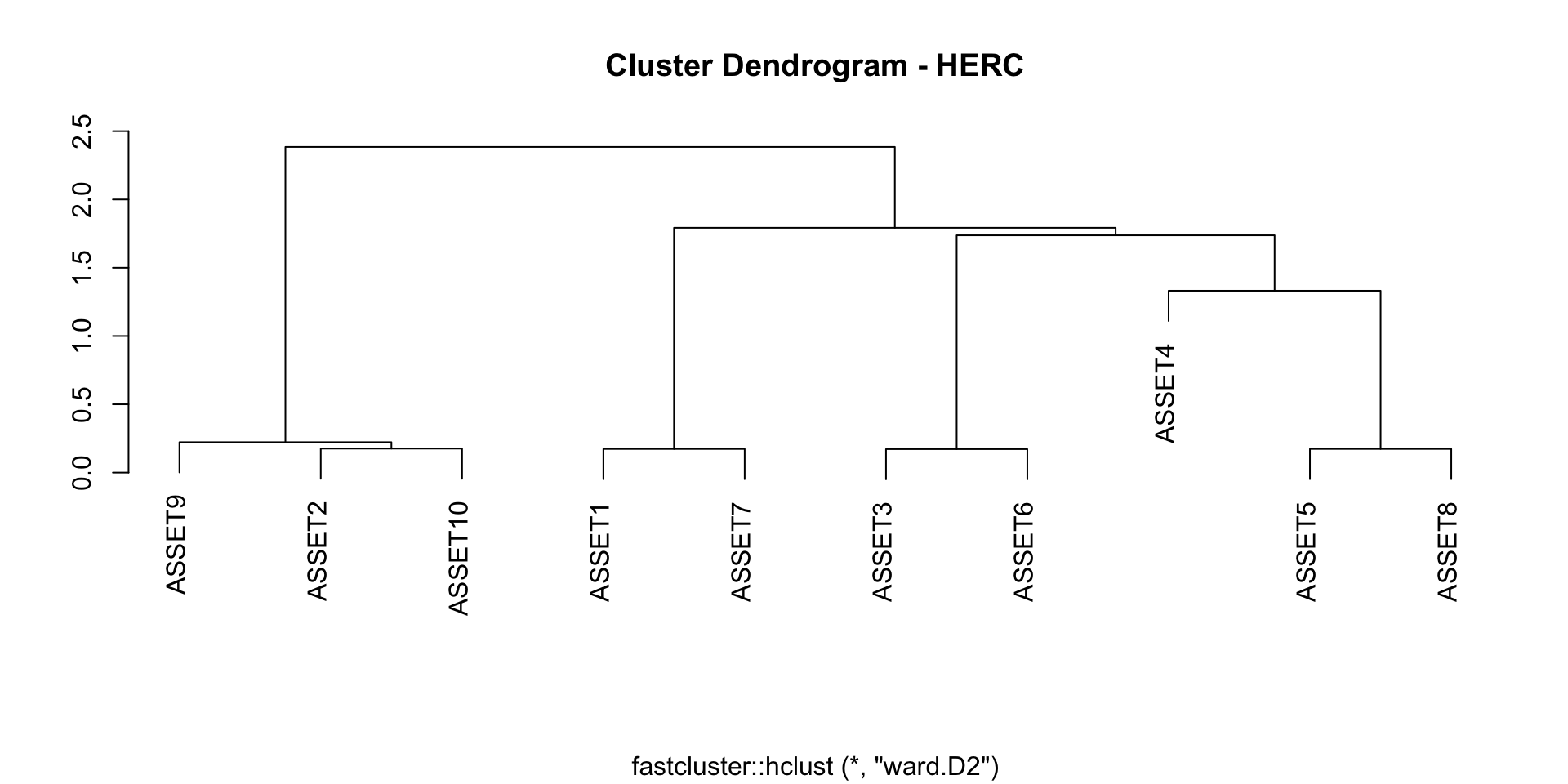

Hierarchical Equal Risk Contribution (HERC)

- HRP faz as bissecções considerando apenas a ordem do dendrograma e não o dendrograma per se.

- Parecido com HACC mas em lugar de calcular os pesos de forma que o total a ser investido seja dividio de forma igual entre cluster, calcula os pesos de forma que a contribuição ao risco seja a mesma dentro de cada cluter.

- Dentro de cada cluster, utiliza-se o método de volatilidade inversa.

ML Risk-Based Portfolios

Hierarchical Equal Risk Contribution (HERC)

ML Risk-Based Portfolios

Hierarchical Equal Risk Contribution (HERC)

- Fazer um agrupamento hierárquico. Raffinot 2018 sugere utilizar a ligação ward mas qualquer outra ligação poderia ser utilizada.

- Selecionar o número de clusters a serem utilizados segundo algum critério. Raffinot 2018 sugere utilizar o índice Gap.

- Dentro de cada cluster, calcular os pesos (iniciais) segundo o método Naive Risk Parity.

- Utilizando os pesos obtidos no paso anterior, calcular o risco de cada cluster (e em cada hierarquia).

- Em cada hierarquia, calcular os pesos como \(\omega^{(1)} = \dfrac{RC_2}{RC_1 + RC_2}\) e \(\omega^{(2)} = \dfrac{RC_1}{RC_1 + RC_2}\), em que RC é o risco no cluster. Por ultimo, os pesos iniciais serão atualizados utilizando os diveros \(\omega^{(1)}\) e \(\omega^{(2)}\) obtidos.

ML Risk-Based Portfolios

Hierarchical Equal Risk Contribution (HERC)

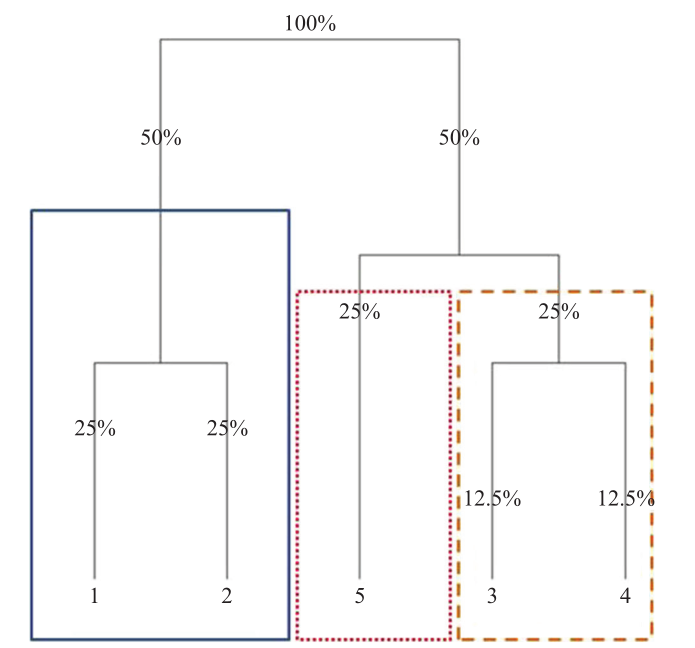

ML Risk-Based Portfolios

Code

MV IV MaxDec MaxDiv ERC HRP DHRP HACC HERC

ASSET1 0.144 0.102 0.049 0.050 0.103 0.070 0.109 0.125 0.078

ASSET2 0.199 0.101 0.037 0.037 0.084 0.076 0.053 0.167 0.278

ASSET3 0.197 0.102 0.120 0.122 0.102 0.108 0.104 0.062 0.017

ASSET4 0.199 0.101 0.197 0.199 0.144 0.190 0.194 0.062 0.008

ASSET5 0.187 0.102 0.077 0.078 0.103 0.097 0.099 0.031 0.004

ASSET6 0.000 0.099 0.075 0.074 0.098 0.102 0.098 0.062 0.016

ASSET7 0.059 0.099 0.155 0.153 0.102 0.066 0.103 0.125 0.074

ASSET8 0.015 0.098 0.125 0.123 0.100 0.091 0.093 0.031 0.004

ASSET9 0.000 0.098 0.053 0.052 0.081 0.071 0.098 0.167 0.261

ASSET10 0.000 0.098 0.112 0.110 0.082 0.128 0.049 0.167 0.260Avaliando Portfolios

Medidas de desempenho

Seja \(p\) o tamanho do período fora da amostra

- Average (AV): \[AV = 12\frac{\sum_{i = 1}^{p}R_{i}}{p},\] em que \(R_{i}\) são os retornos fora da amostra. AV calcula a média anualizado o qual é multiplicado por 12. Quanto maior, melhor o desempenho da carteira.

- Standard Deviation (SD): \[SD = \sqrt{12}\hat{\sigma}_{p},\] em que \(\hat{\sigma}_{p}\) é o desvio-padrão anualizado dos retornos fora da amostra. Quanto menor, menor o risco e tem um desempenho melhor da carteira.

Medidas de desempenho

- Sharpe Ratio (SR): \[SR = \frac{\bar{R}_{p} - \bar{R}_{f}}{\bar{\sigma}_{p-f}},\] em que \(R_{f}\) é a taxa livre de risco, \(\bar{R}_{p}\) é a média dos retornos fora da amostra e \(\bar{\sigma}_{p-f}\) é desvio-padrão estimado do excesso de retorno. Quanto maior, melhor o desempenho da carteira.

- Adjusted Sharpe Ratio (ASR): \[SR = SR(1 + (\frac{\mu_{3}}{6})SR - (\frac{\mu_{4}-3}{24})SR^2),\] em que \(\mu_{3}\) é a assimetria, \(\mu_{4}\) é a cúrtose e \(SR\) é o Sharpe Ratio acima apresentado. Está métrica ajusta o Sharpe ratio incluindo o terceiro e segundo momento amostral. Quanto maior este valor, melhor o desempenho da carteira.

Medidas de desempenho

- Sortino ratio (SO): \[SO = \frac{\bar{R}_{p}}{\sqrt{\frac{\sum_{i=1}^{K}min(0,R_{p,i} - MAR)^2}{K}}},\] em que \(K\) é o tamanho do periodo fora da amostra e MAR é retorno mínimo aceitado, os quais é igual a taxa livre de risco mensal. Quanto maior, melhor o desempenho de portfólio.

Aplicação

Aplicação

Code

Error in dplyr::rename(., ticker = Ticker, company = Company, industry = Industry) :

Can't rename columns that don't exist.

✖ Column `Ticker` doesn't exist.Code

ibov_tickers <- paste0(acoes$ticker, ".SA")

retornos <- yf_get(tickers = ibov_tickers,

first_date = "2010-01-01",

last_date = "2024-04-30",

freq_data = "monthly") |>

select(ref_date, ticker, ret_adjusted_prices) |>

pivot_wider(id_cols = ref_date, values_from = ret_adjusted_prices, names_from = ticker) |>

drop_na()

retornos[, -1] <- retornos[, -1]*100

glimpse(retornos)Rows: 145

Columns: 64

$ ref_date <date> 2012-04-02, 2012-05-02, 2012-06-01, 2012-07-02, 2012-08-01,…

$ ABEV3.SA <dbl> 7.11404489, -7.15027039, 1.25521655, 1.80493276, -0.82423748…

$ ALPA4.SA <dbl> 7.979721, -17.395751, 5.098031, -9.104464, 8.119680, 8.69563…

$ AMER3.SA <dbl> -2.0481893, -25.4612612, -3.4653487, 14.1880461, 17.5149651,…

$ B3SA3.SA <dbl> -4.6263164, -9.8467027, 7.3298642, 12.1950528, -6.0574288, 1…

$ BBAS3.SA <dbl> -9.1329184, -14.9411726, -0.9076693, 11.6230722, 6.8994761, …

$ BBDC3.SA <dbl> -5.1420765, -3.6453849, 0.9580030, 5.6350921, 3.4586492, -1.…

$ BBDC4.SA <dbl> -3.8981990, -3.3072231, 1.9174968, 5.6063285, 4.0235991, -0.…

$ BEEF3.SA <dbl> 22.2065440, -10.4166955, 9.5607187, 8.6084945, 15.3094618, 5…

$ BPAN4.SA <dbl> -9.9560501, -24.3902491, 9.6774017, -22.5490137, 22.7848004,…

$ BRAP4.SA <dbl> 4.0093897, -9.5701796, 4.3726261, -6.7092002, -14.3832978, 6…

$ BRFS3.SA <dbl> -3.1944294, -9.9282766, -2.8186487, -3.4550866, 11.1451994, …

$ BRKM5.SA <dbl> -3.1329618, -16.0447706, 18.9333512, -7.3991204, 3.3091284, …

$ CCRO3.SA <dbl> 0.5160133, 6.0810779, 4.0127475, 4.7152526, 6.6666755, -2.35…

$ CMIG4.SA <dbl> 10.4559178, -6.8819791, 6.6341774, 4.3962597, -11.7661665, -…

$ COGN3.SA <dbl> 0.0000000, 0.0000000, -32.3077009, -9.0909151, 10.0000073, 0…

$ CPFE3.SA <dbl> 0.01621584, -7.39211285, 2.91733701, -6.92914586, -5.8695342…

$ CPLE6.SA <dbl> 14.773955, -15.054880, 7.752282, -4.796352, -14.211029, -8.3…

$ CSAN3.SA <dbl> -2.5323981, -9.4864230, 3.4379528, 0.6776224, 10.8042393, 9.…

$ CSNA3.SA <dbl> -0.2124576, -20.5504500, -12.3941774, -7.4692486, -5.6030157…

$ CYRE3.SA <dbl> -2.8672052, -1.8181497, -2.1164020, 0.0000000, 11.5540384, 5…

$ DXCO3.SA <dbl> -2.693320, -13.749999, 10.041404, 13.360964, 1.924685, 9.113…

$ ECOR3.SA <dbl> -0.3134660, 1.5094219, 0.1858710, 2.5974208, 0.9644228, 5.37…

$ EGIE3.SA <dbl> 1.6138506, 1.8265068, 11.0612363, -1.6150594, -4.8794278, -5…

$ ELET3.SA <dbl> -4.9008186, -18.5889558, 7.3850620, -0.7017479, -7.9858739, …

$ ELET6.SA <dbl> -3.374089, -11.122027, 4.385041, 2.715151, -7.980051, -1.192…

$ EMBR3.SA <dbl> 12.2950973, -12.7128793, -6.3487057, -1.6467131, 6.5449076, …

$ ENEV3.SA <dbl> 8.2206293, -14.6748027, -11.1111101, 7.4675353, 14.1993969, …

$ ENGI11.SA <dbl> -0.4650800, 0.0000000, 0.4672531, -4.6511904, 4.3129832, 6.2…

$ EQTL3.SA <dbl> 2.7007203, 4.4776029, 2.0408541, 1.0666477, 2.5725544, 15.11…

$ EZTC3.SA <dbl> -4.1085802, -4.9881677, 3.1000153, 5.6256111, 12.7180946, 2.…

$ FLRY3.SA <dbl> 1.9087193, -1.7100794, 5.6337791, -16.0392348, 3.5926644, 9.…

$ GGBR4.SA <dbl> 2.6346012, -11.1746864, 11.6015531, 5.1977228, -3.1960870, 7…

$ GOAU4.SA <dbl> 3.37927438, -13.87172438, 10.97742525, 5.32972625, -4.602824…

$ GOLL4.SA <dbl> -16.7350290, -20.7881747, 10.9452751, 7.0627815, 1.5706766, …

$ HYPE3.SA <dbl> -4.8248880, -9.8119419, 7.6155645, 8.6773522, 1.9379790, 13.…

$ ITSA4.SA <dbl> -11.2803817, -2.7594441, -3.3541936, 13.0588685, -2.7055245,…

$ ITUB4.SA <dbl> -14.0770277, -2.2844785, -3.3975812, 14.8364329, -1.4783404,…

$ JBSS3.SA <dbl> 0.000000, -27.333337, 10.642198, -11.111110, 8.955231, 15.06…

$ JHSF3.SA <dbl> -0.1669474, 0.1672266, 0.1669474, 2.5000368, 28.1300602, -3.…

$ LREN3.SA <dbl> 0.34189458, -5.09219500, -2.79818482, 8.73115360, 9.22142011…

$ MGLU3.SA <dbl> -4.8494923, -17.9068265, 0.7502554, 9.0425186, 10.2438995, 8…

$ MRFG3.SA <dbl> -8.7826092, -13.2507266, 2.6373660, 1.1777355, 21.2698320, 2…

$ MRVE3.SA <dbl> -14.3629470, -18.4640387, 7.3903151, 19.8924439, 4.3049439, …

$ MULT3.SA <dbl> 5.50995962, 7.09807752, 2.63047858, 5.41089829, -0.01930367,…

$ PCAR3.SA <dbl> 3.4828470, 0.0000000, 0.9096970, 0.0000000, 0.9097256, 0.000…

$ PETR3.SA <dbl> -7.8600740, -10.6916624, -4.5454710, 6.0846615, 6.2344271, 9…

$ PETR4.SA <dbl> -8.8222474, -9.2159259, -4.6001375, 6.8493476, 6.4615223, 7.…

$ PRIO3.SA <dbl> -13.326792, -38.412409, -7.259255, -20.447291, -6.626503, -4…

$ QUAL3.SA <dbl> 6.0702898, 3.6144655, 2.0930185, 3.9293733, 9.3150904, -0.75…

$ RADL3.SA <dbl> 15.7183309, -9.2015837, 8.8839173, 15.5555703, -7.6922824, 8…

$ RENT3.SA <dbl> -3.1249929, -1.2882515, -5.1562278, 9.7701959, 7.9445975, -0…

$ SANB11.SA <dbl> -7.49999967, 4.89060343, -4.57144353, 0.71429856, -0.0644877…

$ SBSP3.SA <dbl> 7.4361397, -5.1175825, 8.4354465, 13.6103723, -1.5774985, -3…

$ SUZB3.SA <dbl> 0.0000000, 0.0000000, 0.0000000, 0.0000000, 0.0000000, 0.000…

$ TAEE11.SA <dbl> 13.9087829, -16.0177301, 20.9091071, 6.7669179, 3.5211227, 0…

$ TIMS3.SA <dbl> -1.8491505, -14.0211693, 14.4615424, -23.4766907, -6.4402964…

$ TOTS3.SA <dbl> 10.2373737, -1.7496546, 6.0273526, -2.3255395, 4.3650796, 6.…

$ UGPA3.SA <dbl> 8.2499698, -4.1801290, 8.9419339, 6.8583591, -8.5116603, 4.3…

$ USIM5.SA <dbl> -9.075774, -22.161174, -25.647056, 16.772159, 10.433597, 24.…

$ VALE3.SA <dbl> 1.7998567, -11.7605768, 6.7571101, -7.4258605, -9.0713231, 8…

$ VIVT3.SA <dbl> -2.915185, -9.940544, 3.777844, -2.434183, -11.440815, 2.005…

$ WEGE3.SA <dbl> 1.7171847, 3.2770939, -5.9780995, -4.4974075, 8.5899369, 17.…

$ YDUQ3.SA <dbl> 22.01691774, 6.30252417, -3.95256318, 3.82714815, 24.8513624…Aplicação

Code

n_obs <- nrow(retornos)

ins <- 90

oos <- n_obs - ins

Rp <- matrix(NA, ncol = 10, nrow = oos)

for (i in 1:oos) {

r <- retornos[i:(i + ins - 1), -1]

Sigma <- cov(r)

w_mv <- optimalPortfolio(Sigma, control = list(type = 'minvol', constraint = 'lo'))

w_iv <- optimalPortfolio(Sigma, control = list(type = 'invvol', constraint = 'lo'))

w_erc <- optimalPortfolio(Sigma, control = list(type = 'erc', constraint = 'lo'))

w_md <- optimalPortfolio(Sigma, control = list(type = 'maxdiv', constraint = 'lo'))

w_mdec <- optimalPortfolio(Sigma, control = list(type = 'maxdec', constraint = 'lo'))

w_hrp <- HRP_Portfolio(Sigma)$w

w_dhrp <- DHRP_Portfolio(Sigma)$w

w_hcaa <- HCAA_Portfolio(Sigma)$w

w_herc <- HERC_Portfolio(Sigma)$w

Rp[i, ] <- c(mean(as.numeric(retornos[i + ins, -1])),

sum(w_mv * retornos[i + ins, -1]),

sum(w_iv * retornos[i + ins, -1]),

sum(w_erc * retornos[i + ins, -1]),

sum(w_md * retornos[i + ins, -1]),

sum(w_mdec * retornos[i + ins, -1]),

sum(w_hrp * retornos[i + ins, -1]),

sum(w_dhrp * retornos[i + ins, -1]),

sum(w_hcaa * retornos[i + ins, -1]),

sum(w_herc * retornos[i + ins, -1]))

}[1] "Number of clusters: 7"

[1] "Number of clusters: 7"

[1] "Number of clusters: 7"

[1] "Number of clusters: 6"

[1] "Number of clusters: 6"

[1] "Number of clusters: 7"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 6"

[1] "Number of clusters: 5"

[1] "Number of clusters: 6"

[1] "Number of clusters: 6"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 6"

[1] "Number of clusters: 6"

[1] "Number of clusters: 6"

[1] "Number of clusters: 6"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 5"

[1] "Number of clusters: 6"

[1] "Number of clusters: 5"

[1] "Number of clusters: 6"

[1] "Number of clusters: 6"

[1] "Number of clusters: 5"

[1] "Number of clusters: 6"

[1] "Number of clusters: 6"

[1] "Number of clusters: 6"

[1] "Number of clusters: 6"

[1] "Number of clusters: 6"

[1] "Number of clusters: 6"

[1] "Number of clusters: 6"

[1] "Number of clusters: 6"

[1] "Number of clusters: 6"

[1] "Number of clusters: 6"

[1] "Number of clusters: 6"

[1] "Number of clusters: 6"Aplicação

Code

medidas <- function(x) {

# Annualized Average

AV <- mean(x)

# Annualized SD

SD <- sd(x)

# Information (or Sharpe) Ratio

SR <- mean(x)/sd(x)

# Adjusted Sharpe Ratio

ASR <- SR*(1 + (moments::skewness(x)/6)*SR - ((moments::kurtosis(x) - 3)/24)*SR^2)

# Sortino Ratio

SO <- mean(x)/sqrt(mean(ifelse(x < 0, 0, x^2)))

output <- c(12*AV, sqrt(12)*SD, sqrt(12)*SR, sqrt(12)*ASR, sqrt(12)*SO)

return(output)

}Aplicação

Code

AV SD SR ASR SO

EW 10.585417 28.03836 0.3775333 0.3698439 0.5406683

Min Var 13.658973 21.14320 0.6460221 0.6323241 0.8237391

Inv Vol 10.113954 25.93608 0.3899569 0.3815767 0.5565186

ERC 11.199226 24.85598 0.4505647 0.4408735 0.6268675

Max Div 13.233163 25.63452 0.5162243 0.5055968 0.6852115

Max Dec 13.879596 29.98986 0.4628096 0.4607294 0.5980135

HRP 9.800678 22.73546 0.4310745 0.4207513 0.6075124

DHRP 11.410010 22.64509 0.5038625 0.4891308 0.6968257

HCAA 14.883575 27.89803 0.5334992 0.5188800 0.7302500

HERC 17.693374 56.85116 0.3112228 0.3022183 0.4777920Tópicos de pesquisa

Tópicos de pesquisa

- Custos de transação / Otimização

- Outros estimadores da matriz de covariância

- Variância (covariância) condicional

- Dados em alta dimensão

- Dados em alta frequência

- Metodologias híbridas

Carlos Trucíos (IMECC/UNICAMP) | Semana da Estatística UFJF 2024 | Risk-Based Portfolio Allocation | ctruciosm.github.io